- Blog

- Which Car Taxes Do You Need to Pay in Spain

Which Car Taxes Do You Need to Pay in Spain

Get a clear overview of car taxes in Spain, including IVA, IEDMT, IVTM, and learn how to calculate, deduct, and pay them as a dealer.

Belangrijkste punten

- Spain has multiple car-related taxes, including IVA (VAT), IEDMT (registration tax), IVTM (road tax), ITP (transfer tax), and customs duty for non-EU imports.

- VAT-registered businesses can deduct IVA, but IEDMT, IVTM, and customs duties are not deductible.

- IEDMT is based on CO₂ emissions, and the rate can vary slightly by region. Electric vehicles are fully exempt.

- Tax exemptions and reductions are available for electric vehicles, low-emission hybrids, large families, people with disabilities, and other specific cases.

- You can pay most car taxes online through the Agencia Tributaria website (for IVA and IEDMT) or through your local municipality (for IVTM).

If you want to import or register vehicles in Spain, you’ll be dealing with several taxes. That’s alright—we’ll guide you through each of them so that you can plan costs and stay compliant.

From Spanish registration tax (IEDMT) to road tax in Spain, the exact amount you pay will vary depending on the region, the type of vehicle, and whether you’re a business or private buyer.

Even though car taxes in Spain aren’t the same across the country, it’s still important to understand the basics.

Knowing what to expect helps you price vehicles correctly and answer customer questions with confidence, so let’s look at the main car taxes in Spain and see how they work.

List of all motor taxes in Spain

To help you get started, here’s a quick overview of the main car taxes in Spain. We’ll look at each one in more detail later.

|

Acronym |

Full tax name |

When is it paid? |

Tax deduction available? |

Who pays? |

|

IVA |

Impuesto sobre el Valor Añadido (Value added tax, VAT) |

When buying and importing vehicles in Spain or EU |

Yes, for VAT-registered businesses |

Dealer when importing, buyer when purchasing from dealer |

|

IEDMT |

Impuesto Especial sobre Determinados Medios de Transporte |

On first registration in Spain |

No |

Whoever registers the car (dealer or buyer) |

|

ITP |

Impuesto de Transmisiones Patrimoniales |

When buying a used car from a private seller |

No |

Private buyers (no dealership involved) |

|

IVTM |

Impuesto sobre Vehículos de Tracción Mecánica (Circulation tax) |

Annually after registration |

No |

Registered owner (dealer or buyer) |

|

Customs duty |

Spanish: Aduanas |

When importing from non-EU |

Usually not deductible, but VAT may be deductible for businesses |

Dealer |

IVA tax explanation

IVA (Impuesto sobre el Valor Añadido) is Spain’s standard value-added tax, similar to VAT in other EU countries. It applies when you:

- Buy a new or used vehicle from a dealer in Spain

- Import a vehicle from another EU country

- Import a vehicle from outside the EU

The standard IVA rate in Spain is 21%. The reduced tax brackets (10% and 4%) don’t apply to vehicles.

How to calculate IVA tax?

The IVA tax (21%) is usually paid when importing or buying a vehicle, but the way you calculate it depends on where the car is coming from. Here are the three most common scenarios for dealers:

► Buying a car from an EU dealer

If you’re buying from another EU-based business and the invoice is issued without VAT, you need to declare 21% IVA in Spain. You can deduct it later, if you’re a VAT-registered business.

► Buying a car from a Spanish dealer

If you buy from a dealer in Spain, IVA is usually included in the invoice, so you don’t have to calculate it separately. You can also deduct it later if you’re VAT registered.

► Importing a car from outside the EU

Here, IVA is paid during customs clearance. IVA is 21% of the customs value (car price + shipping + customs duty).

How to reclaim your IVA tax?

So, if you’re a VAT-registered business buying from other businesses, you can typically deduct the IVA paid on vehicle purchases.

To reclaim IVA:

- Ensure the invoice includes your company VAT number and is properly issued. All invoices issued by eCarsTrade will have VAT info clearly stated.

- File your regular VAT return with the Spanish tax office (Agencia Tributaria). You’ll need to fill in the Form 303.

- Keep all supporting documents (invoice, proof of payment, transport documents).

IEDMT tax explanation

IEDMT (Impuesto Especial sobre Determinados Medios de Transporte) is a one-time registration tax paid when a vehicle is first registered in Spain, whether it’s new or used, imported or bought locally.

How to calculate IEDMT tax?

The amount depends mainly on CO₂ emissions, but it can also vary by region.

For the most accurate estimation, you should refer to the regional rates based on where the car will be registered, which you can find here.

IEMDT rates in Autonomous Communities

Some Autonomous Communities, such as Madrid, Catalonia, or Navarra, apply regional surcharges, especially on high-emission vehicles.

To estimate the cost of the IEDMT tax, you should check the official CO₂ emissions of the vehicle (which you can find in the car’s COC) and refer to the regional tax rules based on where the vehicle will be registered.

The payer of the IEDMT submits a tax declaration using Form 576.

✅ Note that the same CO₂ value used for IEDMT also determines which DGT eco sticker your car gets.

These stickers matter because they affect where you can drive in cities and can even impact how easy the car is to sell later.

ITP tax explanation

ITP, the Transfer tax, is only paid when an individual buys from a private seller. The rate depends on the region, it ranges between 4% to 8% of the car’s market value.

Registered car dealers don’t pay ITP, they sell via the IVA system.

IVTM tax explanation

IVTM (Impuesto sobre Vehículos de Tracción Mecánica) is a yearly road tax paid by the registered owner of the vehicle.

It’s a local tax, meaning it’s collected by the municipality where the vehicle is registered, so rates depend on the city or town.

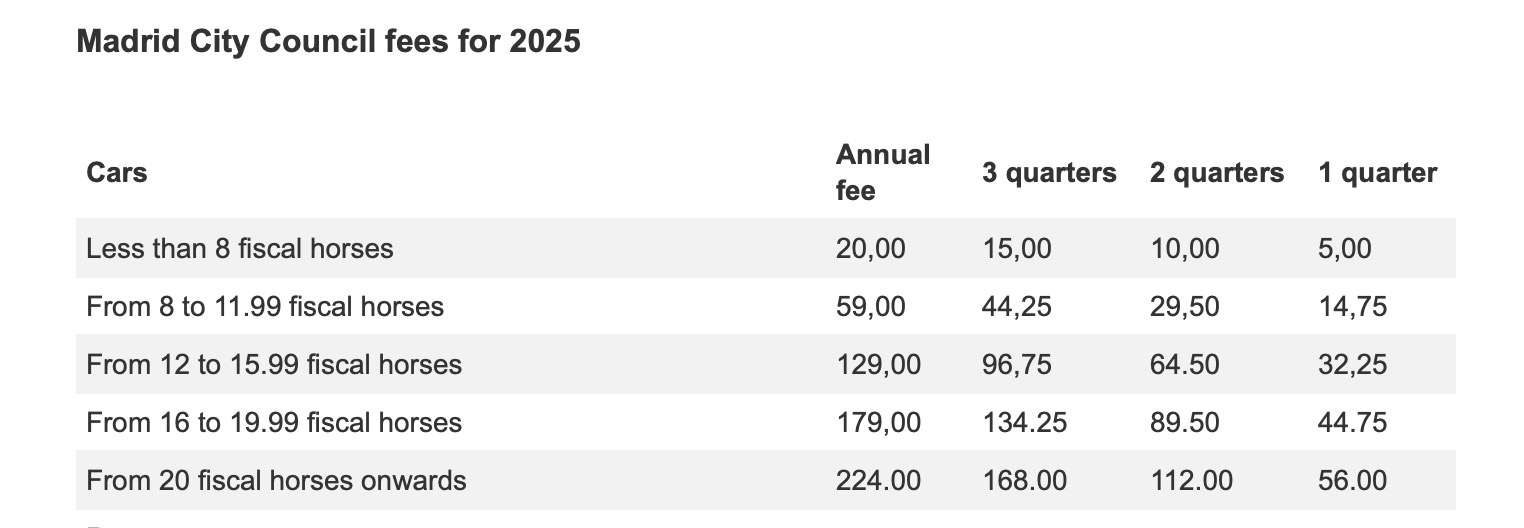

For instance, the table below shows the official 2025 IVTM rates in Madrid, based on the vehicle’s fiscal horsepower (caballos fiscales).

Madrid IVTM fees for cars in 2025

You can also see how the fee is adjusted if the car is registered only for part of the year.

How to calculate IVTM tax?

The tax is based on:

- Vehicle type and engine power (or emissions in some cities)

- The municipality where it’s registered

That’s why it’s best to visit the official pages of the local tax office to check the exact rates and payment options.

When it comes to the question of who pays the IVTM, it’s always the person or business listed as the registered owner of the vehicle.

If the car is still in the dealer’s name, the dealer pays. If it has already been transferred, the new owner pays.

Customs duties explanation

If you’re importing a car from outside the EU, you’ll need to pay customs duties and import VAT when the car enters Spain.

How to calculate customs duties?

Customs duties are based on the customs value of the vehicle. This includes the car’s purchase price, transport costs, and insurance up to the EU border. For most cars, the duty rate is 10%.

For motorcycles, the rates are different:

- 8% for motorcycles with engines up to 250 cm³

- 6% for motorcycles with engines of 250 cm³ or more

After customs duties are applied, import VAT is charged at 21% on the total amount (customs value + customs duty).

Tax exemptions and reductions

Like many EU countries, Spain offers tax benefits and incentives to support cleaner vehicles, especially electric ones.

With some taxes, you don’t have to pay the full amount, and in some cases, you may not have to pay them at all.

For example, electric vehicles and plug-in hybrids are often exempt from the registration tax (IEDMT), and some hybrid vehicles with lower emissions pay reduced IEDMT.

Also, many municipalities offer up to 75% reduction in IVTM (the road tax) for EVs and certain hybrids.

There are also tax benefits for:

- Large families

- People with disabilities

- Taxis and rental fleets

- Vehicles imported as part of a change of residence

- Adapted vehicles

Tax calculation example

So, how do all these taxes come together in practice? We’ll now see a real-world example to show how to calculate the total cost of importing and registering a used vehicle in Spain.

Let’s say that you were importing a used Audi A4 (145 g/km CO₂) from Germany. If the car cost €15,000, here’s what you would have to pay as an importing dealer:

1. Declare and pay IVA (21%) in Spain

Since it’s a purchase in the EU, you need to declare 21% IVA in Spain:

€15,000 × 21% = €3,150

Your total declared value is €18,150.

✅ Remember, if you're VAT-registered, you can deduct the IVA in your next quarterly VAT return (Form 303).

2. Pay the IEDMT (registration tax)

Because the car emits 145 g/km of CO₂, it falls into the 4.75% tax bracket.

That means you’ll pay €712.50 in IEDMT (that’s 4.75% of €15,000).

You’ll need to fill out the Form 576 and pay the tax before you can register the car.

3. Skip ITP

Since this isn’t a private-to-private sale, there’s no transfer tax (ITP).

4. Pay IVTM (annual road tax)

After registration, you’ll need to pay IVTM based on the municipality where the car is registered. Let’s say that you were registering in Madrid, and assume that the Audi A4 had 15 CVF, placing it in the 12–15.99 CVF bracket.

In that case, you (or the buyer who registers the car) would pay €129 per year in IVTM.

So, the final total in car taxes: €3,150 (IVA) + €712.50 (IEDMT) + €129 (IVTM) = €3,991.50

That’s the full amount you’d pay in taxes as a dealer importing and registering this vehicle in Madrid. If you’re VAT-registered, you’ll be able to deduct the €3,150 in IVA.

How to pay taxes on EVs and imported EVs?

If you were importing motorcycles or light commercial vehicles (LCV), you’d follow similar procedures as when importing cars.

However, paying taxes on EVs is a bit different. There are two key things to keep in mind:

- Customs duty and VAT apply to imports, but EVs are fully exempt from IEDMT registration tax.

- Many municipalities also offer annual IVTM discounts for electric vehicles, so check local tax rules.

To benefit from the EV IEDMT exemption, present a certificate of zero CO₂ emissions with your registration documents.

Spanish car taxes - FAQ

► Who is exempt from paying taxes?

The following categories are exempt from paying some taxes: EVs, hybrids, diplomats, rental fleets, first residency imports, large families, disabled persons.

► How to calculate car import tax for a car coming from a non-EU country?

You’ll have to combine these costs: customs duty + 21% IVA + IEDMT.

► What is the difference between IEDMT and ITP?

ITP is only paid in transactions between private individuals, while IEDMT is paid by anybody first registering a car in Spain, whether they’re a business or a private buyer.

► Can businesses deduct or recover car import taxes in Spain?

Yes, VAT-registered businesses can usually deduct the 21% IVA paid when importing or buying vehicles. IEDMT and customs duties are not deductible.

► Which documents are needed for car tax payments?

You’ll typically need:

- A valid vehicle purchase invoice or sales contract

- Certificate of Conformity (COC)

- Proof of customs clearance (if importing from outside the EU)

- NIE/CIF (tax number)

- Form 576 (for IEDMT) or Form 303 (for VAT return, if reclaiming)

You may need additional documents depending on the type of vehicle and tax.

► Which documents are needed for tax exemptions?

Depending on the exemption you’re applying for, you’ll need proof of eligibility (e.g. large family certificate, disability status, proof of vehicle adaption). If you’re applying for an IEDMT exemption for electric vehicles, you’ll need a certificate of zero CO₂ emissions.

► How to pay Spanish car taxes online?

You can pay IEDMT and IVA on Agencia Tributaria pages. IVTM is paid through your local municipality’s website.

► What taxes do I need to pay for vehicle ownership transfer?

If buying from a private individual, you must pay the ITP (4–8%), based on the car’s market value and the region

If buying from a dealer, you pay IVA (21%), which is already included in the invoice.

In both cases, a DGT transfer fee also applies. The cost of the transfer fee is €55.70.

► What is the tax on used cars in Spain?

If you’re buying from a private seller, you pay ITP (4–8%). If you’re buying from a dealer, you pay IVA (21%).

Het importeren van voertuigen uit Europa kan ingewikkeld zijn, maar eCarsTrade is er om het proces te vereenvoudigen. Zo doen we dat:

_01JE9WH8CRTMG3B3WDH56WNJHD.png)