- Blog

- Calculating Denmark’s Registreringsafgift Tax

Calculating Denmark’s Registreringsafgift tax

Learn how to calculate Denmark’s registreringsafgift in 2025. You'll see tax brackets, CO₂ surcharges, EV deductions, and real examples for petrol, electric, and commercial vehicles.

Buying or importing a car to Denmark comes with one of the highest registration taxes in Europe, the registreringsafgift.

As a car trader, knowing how this tax works is important so that you can plan costs and make sure your cars stay profitable.

In this guide, we’ll guide you through everything you need to know about Denmark’s car tax in 2025. You’ll see example calculations for a petrol car, an electric vehicle, and a commercial van, and learn how depreciation can reduce the registreringsafgift on imported used cars.

Let’s start!

Belangrijkste punten

- Denmark’s registreringsafgift is based on vehicle value, type, and emissions. For passenger cars in 2025, the tax brackets are 25%, 85%, and 150% of the car value.

- EVs benefit from a DKK 165,000 deduction (private cars) and pay only 40% of the calculated tax until 2026.

- From 2026, EV and hybrid tax rates will rise gradually until they are taxed the same as petrol and diesel cars by 2035.

Calculating registreringsafgift in Denmark

Denmark’s registreringsafgift is a registration tax you pay when a car is registered for the first time. The tax amount isn’t fixed. Instead, it’s based on the car’s value, type, and emissions.

So, two cars with the same price can receive very different tax bills depending on whether they’re petrol, diesel, hybrid, or electric.

To calculate the tax, you need three main elements:

- The value of the car (based on market value in Denmark, not just the invoice price)

- The vehicle type (private car, van, motorcycle, etc.)

- The CO₂ emissions and whether the car qualifies for deductions (e.g. EVs, low-emission cars)

To help estimate the tax, many traders use the official Danish car tax calculator from Motorstyrelsen. You’ll see what it looks like in a bit, but first, let’s look at the current tax rates in 2025.

Tax rates in 2025

Here’s an overview of the current registreringsafgift rates in Denmark for different vehicle types in 2025.

► Private car rates

- 25% on value up to DKK 72,900

- 85% on value between DKK 72,900 and 226,500

- 150% on value above that

► Van/Commercial vehicle rates

- The first DKK 84,000 of the vehicle’s value is tax-free (you pay 0% tax on that part)

- On the value above DKK 84,000, you pay 50% tax.

There’s an exemption for certain vans (open vans, pickups, or box vans with no side window behind the driver, and weighing over 3,000 kg).

For such vehicles, the tax is limited at DKK 47,000 to keep heavy commercial vehicles affordable for businesses.

► Motorcycle rates

- 25% up to DKK 22,500;

- 85% from 22,500 to 76,200;

- 150% on the rest

► Electric car rates

If you register an EV before 2026, you pay only 40% of the calculated tax. You also subtract a special deduction from the car’s value before tax is applied:

- Private electric cars: DKK 165,000

- Electric vans: DKK 77,500

- Electric motorcycles: DKK 104,000

So, if you import an electric car worth about DKK 224,000 (€30,000), you subtract the DKK 165,000 deduction, which leaves DKK 59,000 as the taxable value.

The tax is then calculated on that amount, and because EVs pay only 40% before 2026, the final tax bill stays relatively low.

► Co2 surcharges

On top of the regular tax, there’s an extra CO₂ charge based on the car’s emissions:

- 0–109 g/km: DKK 280 per gram

- 109–139 g/km: DKK 560 per gram

- Above 139 g/km: DKK 1,064 per gram

For vans, lorries, and motorhomes, the CO₂ surcharge is simpler: a flat DKK 280 per gram, no matter the level.

Tax rate summary table for 2025

To make things clearer, here’s a summary of the 2025 registreringsafgift rates for different vehicle types.

|

Vehicle type |

Base tax brackets |

Base deduction |

|

Passenger car |

|

DKK 24,300 |

|

Van / commercial |

|

DKK 33,600 |

|

Motorcycle |

|

- |

In addition to the base brackets, there are extra deductions for EVs and low-emission cars, and CO₂ surcharges that can increase the final tax.

|

Vehicle type |

EV deduction |

Low-emission deduction |

CO₂ surcharge |

|

Passenger car |

DKK 165,000 |

DKK 45,000 (and pay 65% of tax) |

|

|

Van / commercial |

DKK 77,500 |

- |

280 DKK/g |

|

Motorcycle (EV) |

DKK 104,000 |

- |

- |

|

EVs (general) |

Only 40% of calculated tax until 2026 |

- |

- |

How to calculate Danish car tax for imported used vehicles

When you import a used car into Denmark, the same brackets, deductions, and CO₂ surcharges apply as for new cars. The difference is that the tax is based on what the car would be worth on the Danish market.

That value takes into account the car’s age, mileage, condition, and equipment. In other words, depreciated cars will get you a lower tax.

For dealers, this often makes cars with higher mileage an effective way to lower the registration tax while still finding cars that sell well in Denmark.

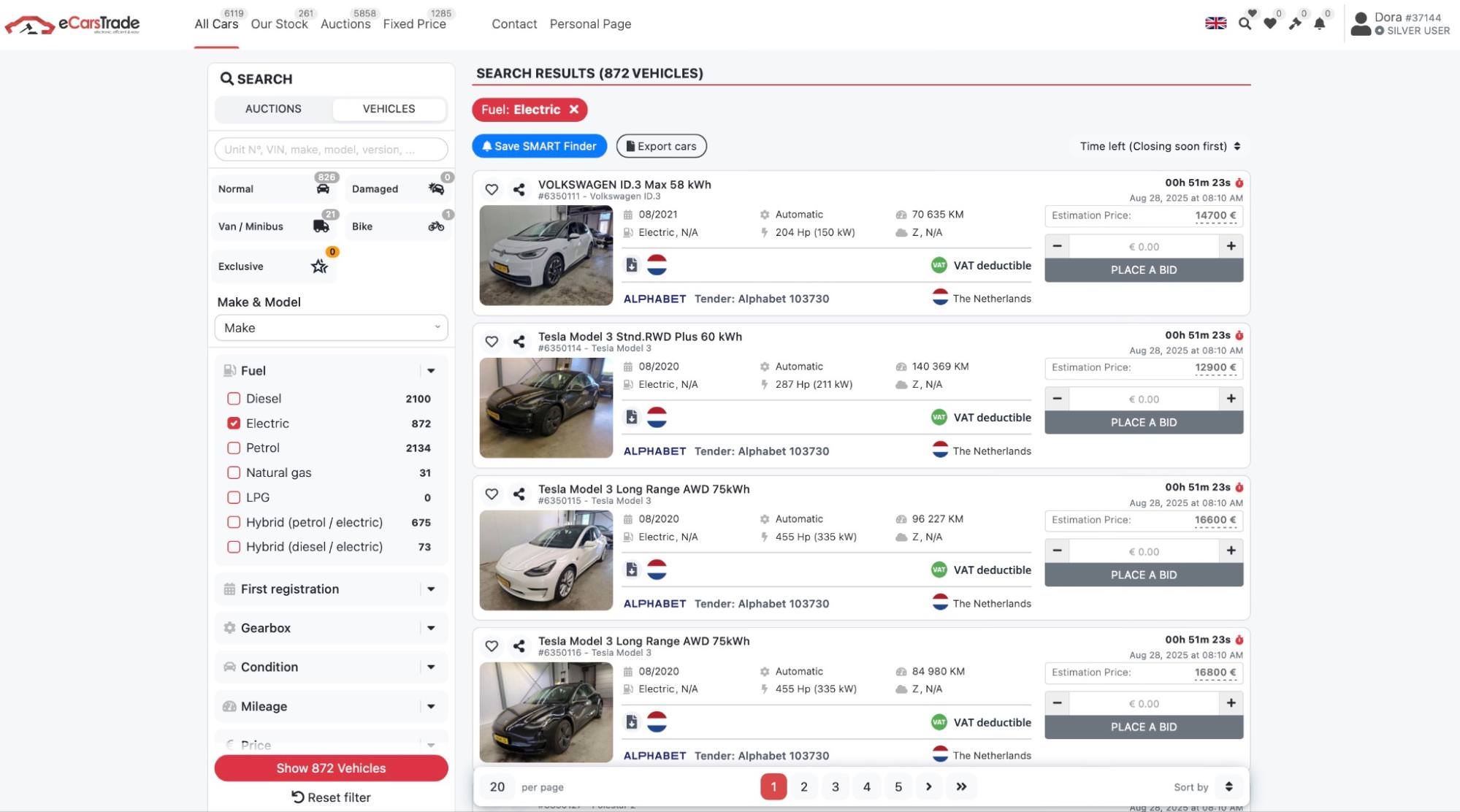

Buy with eCarsTrade

As you can see, importing cars can be an affordable way to expand your dealership’s offer in Denmark. Sourcing cars from eCarsTrade gives you access to vehicles from across Europe, with clear pricing and no hidden fees.

You could start your search by filtering by fuel type and focusing on EVs if they sell well in your area.

These are also a good option for import because they benefit from large deductions and only pay 40% of the calculated registreringsafgift before 2026.

Of course, eCarsTrade isn’t limited to used EVs. You can also find petrol, diesel, hybrids, and ex-lease vans, all with the same buying process that helps you plan your costs before bidding.

Real-life example calculation

Now, let’s go to the official Denmark car tax calculator and see how the numbers work in practice. Here are three different cases that traders often look at.

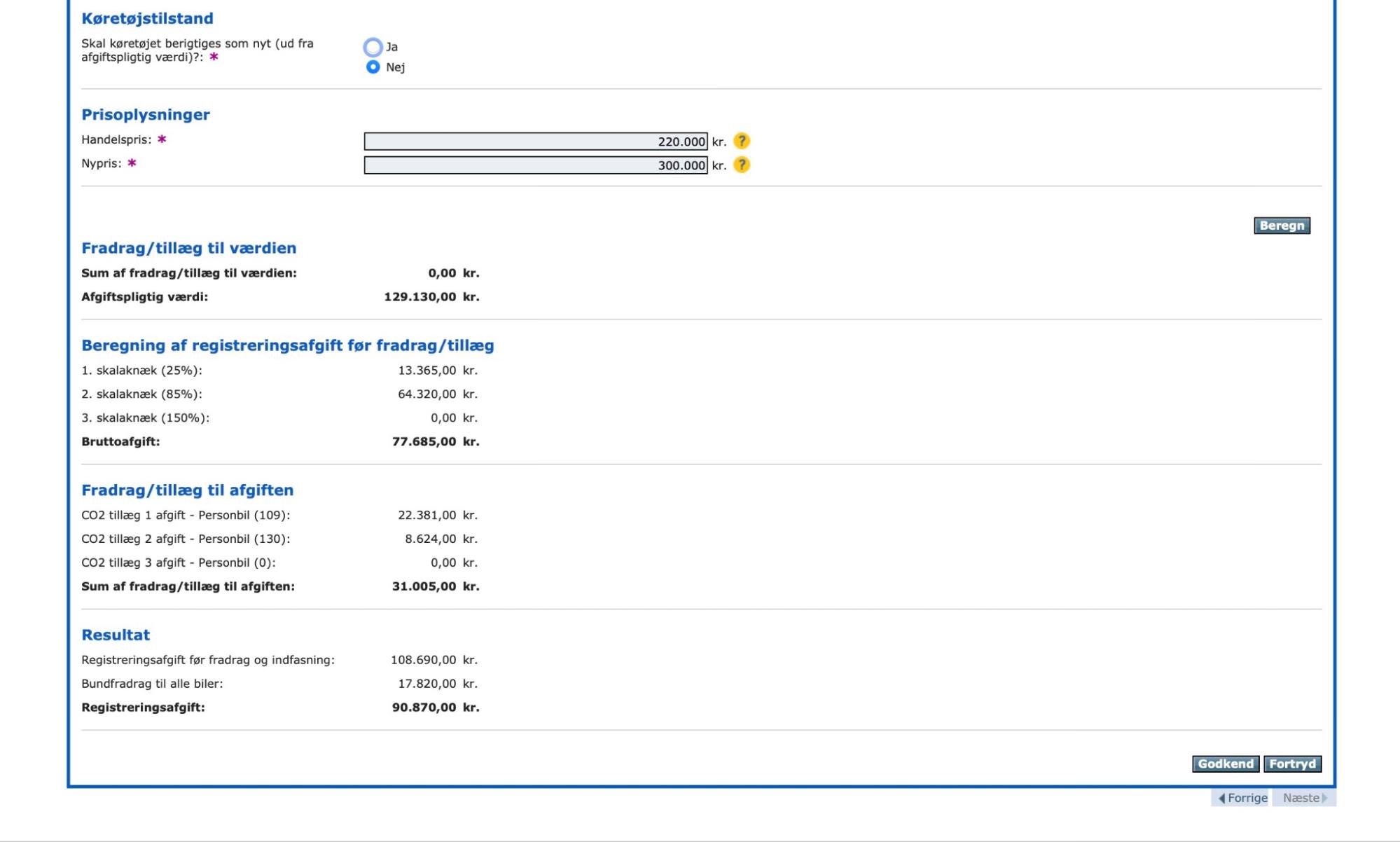

► 2-year old petrol car

Let’s say you imported a 2023 VW Golf 1.5 TSI petrol with about 35,000 km mileage. Its Danish market value is estimated at DKK 220,000, while the original new price in Denmark was DKK 300,000.

You’ll type these estimations into the calculator, along with the info about the car, and here's the tax you'll end up with:

According to the official tax calculator, the system first applies the standard tax brackets and adds a CO₂ surcharge.

After subtracting the base deduction, the final registreringsafgift is DKK 90,870.

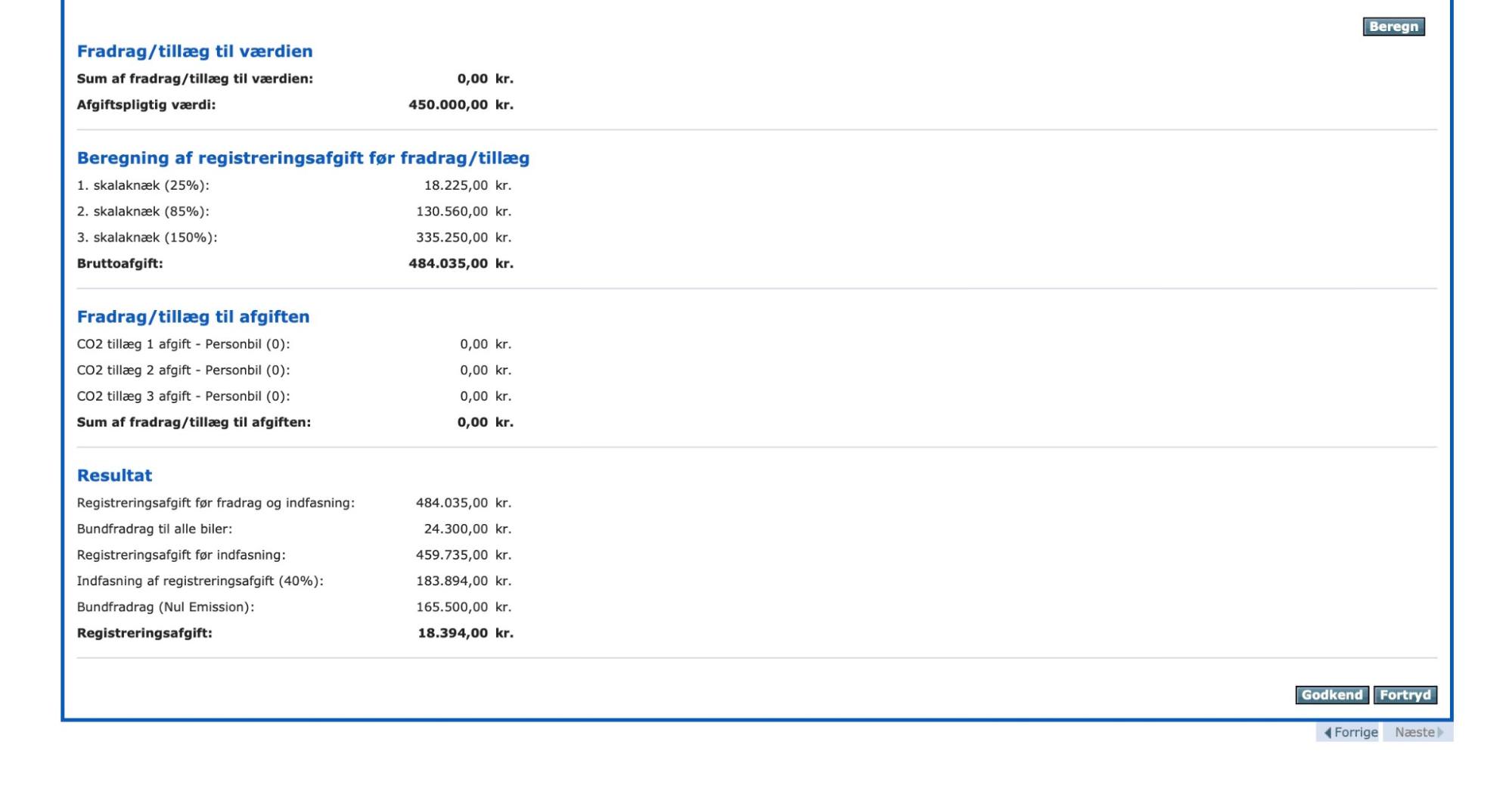

► New electric vehicle

Now, consider a new Tesla Model Y Long Range (electric) with a Danish market price of about DKK 450,000.

For EVs, the rules are different. You first subtract a DKK 165,500 deduction, then a general base deduction, and after that only 40% of the tax is charged until 2026. Because electric cars have 0 g/km CO₂ emissions, there is no extra surcharge.

With these rules, the official calculator shows a final registreringsafgift of just DKK 18,394.

This is far lower than for a petrol or diesel model with the same price, showing how strong the incentives for EVs still are in Denmark.

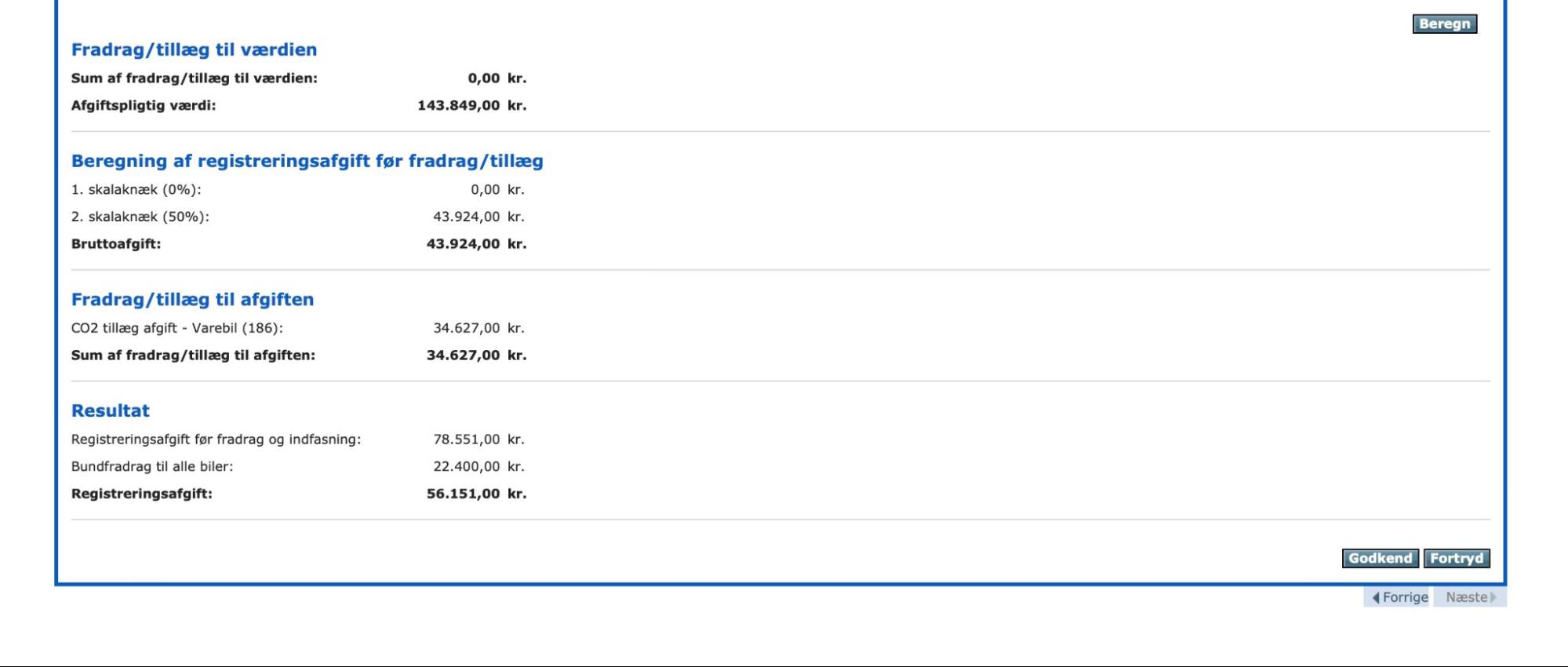

► Commercial van

Let’s see the tax of a 2022 Ford Transit Custom 2.0 EcoBlue diesel van with a Danish market value of about DKK 200,000 and an original new price of DKK 300,000.

For vans, the first DKK 84,000 of the value is tax-free, and the rest is taxed at 50%. On top of that, there is a CO₂ surcharge of DKK 280 per gram. With emissions of around 186 g/km, this adds a high extra cost.

According to the official calculator, the final registreringsafgift comes to DKK 56,151.

These examples give a good idea of how the tax works, but the exact amount will always depend on the specific car details, like its price, age, mileage, equipment, and emissions.

So, you should enter every vehicle through the calculator before making import or pricing decisions.

What changes for EVs and hybrids in 2026?

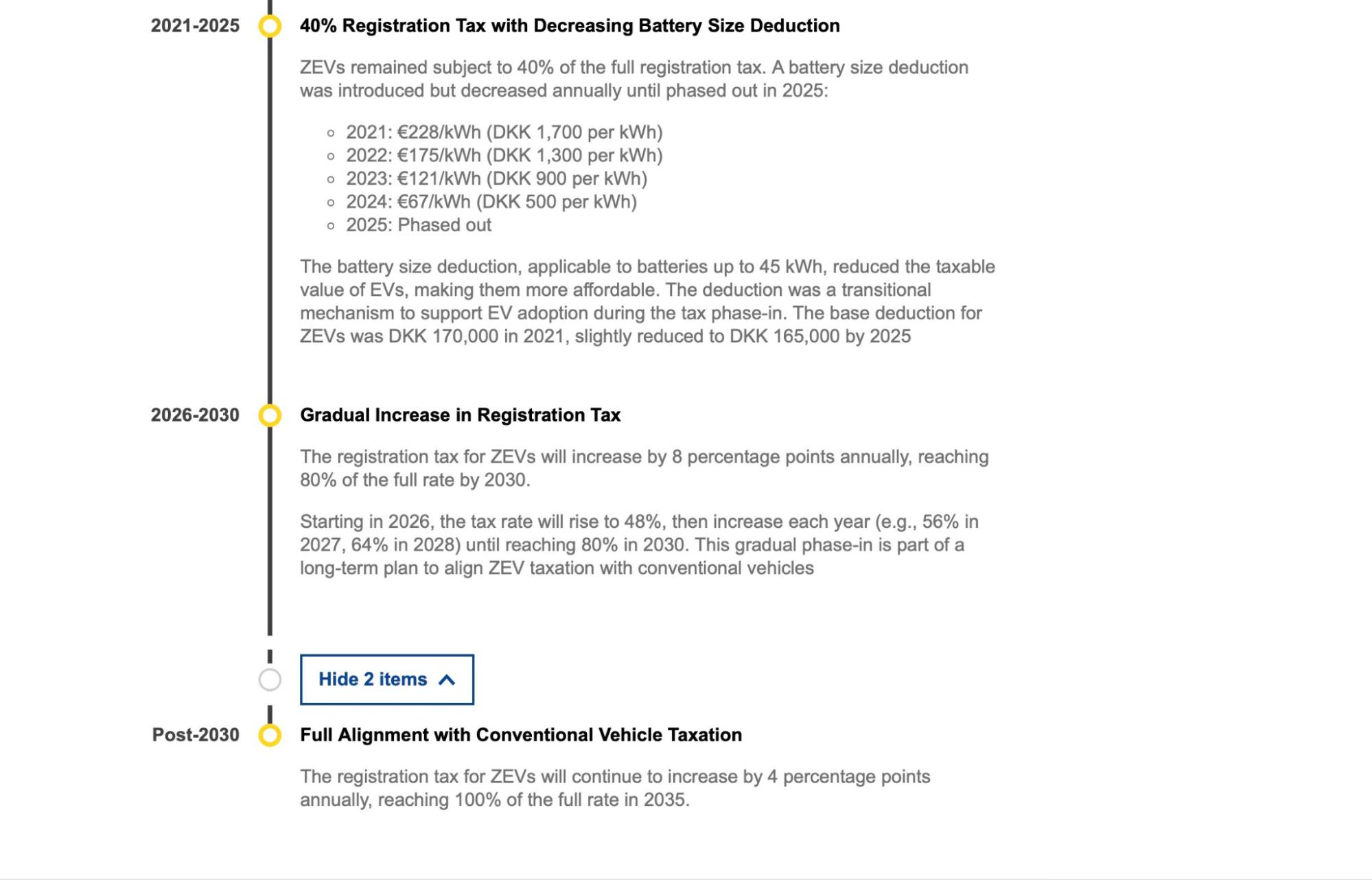

Up until the end of 2025, EVs only pay 40% of the normal registreringsafgift and benefit from special deductions. However, this will change starting in 2026.

According to the European Alternative Fuels Observatory timeline, the registration tax for EVs will rise to 48%, and then increase by 8% each year until it reaches 80% in 2030.

Source: European Alternative Fuels Observatory

Plug-in hybrids already pay more tax than EVs today (65% in 2025), and they will also have their percentage gradually increased each year until they are taxed the same as petrol and diesel cars by 2035.

So, if you’re looking to import to Denmark, remember that EVs may be much cheaper to register now than in just a few years.

FAQ

► How much tax on used cars in Denmark?

Tax is based, among other factors, on the value of a car’s market value in Denmark.

For passenger cars in 2025, the tax brackets are 25%, 85%, and 150% of the car value. There are also deductions and surcharges that can change the amount.

► How much tax on imported cars in Denmark?

Imported cars also follow the same registreringsafgift rules, and the price is based on the car’s market value in Denmark rather than just the foreign invoice price.

► Why is the motor tax rate in Denmark so high?

Because the system is designed to limit the number of cars on the road and encourage lower-emission vehicles.

► Can I reduce my car tax in Denmark?

Yes, mainly through the type of vehicle you choose. EVs and hybrids get big deductions and lower rates until 2026, and low-emission cars have extra discounts. For used imports, the lower market value also reduces the tax.