- Blog

- Markt voor gebruikte auto's in Europa: trends en analyse in het eerste en tweede kwartaal van 2024

Markt voor gebruikte auto's in Europa: trends en analyse in het eerste en tweede kwartaal van 2024

Ontdek de nieuwste trends op de Europese markt voor gebruikte auto's voor het eerste en tweede kwartaal van 2024, en ontdek de belangrijkste ontwikkelingen om uw dealerbedrijf de komende kwartalen te helpen bloeien.

Na de achtbaan van 2023, gekenmerkt door verstoringen van de toeleveringsketens en inflatie, heeft 2024 een verfrissende verandering gebracht.

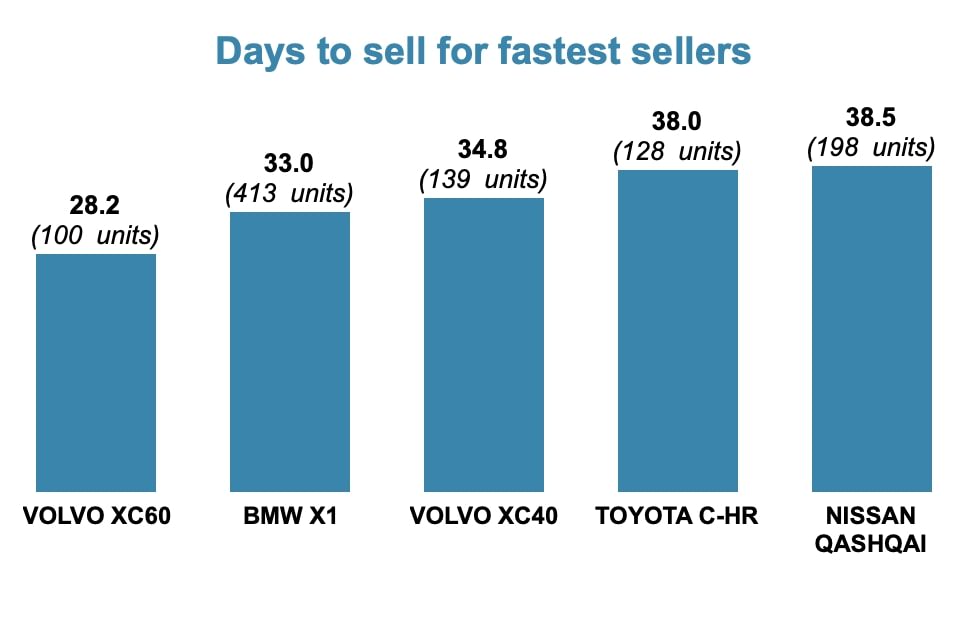

Om precies te zijn: begin 2024 waren er positieve trends in de transacties met gebruikte auto's in Frankrijk, Duitsland, Italië en Spanje. We hebben het hier over significante cijfers. Italië heeft bijvoorbeeld 8,5% meer transacties met gebruikte auto's vergeleken met het jaar ervoor.

Bron: Autovista24

Bron: Autovista24

Toch zijn er nog twee kwartalen voordat het jaar voorbij is, en veel dealers van gebruikte auto's bevinden zich op een markt met fluctuerende prijzen. Daarom hebben we een overzicht gemaakt van de belangrijkste trends per land.

Laten we de gegevens over gebruikte auto's uit het eerste en tweede kwartaal analyseren om u inzicht te geven in de marktdynamiek.

Duik dus met ons mee in de eerste twee kwartalen van 2024, zodat u voor de rest van het jaar weloverwogen beslissingen kunt nemen.

Overzicht van de Europese markt voor gebruikte auto's in Q1 en Q2 2024

EV’s kenden begin dit jaar een sterke start. Autovista meldt dat het slechts gemiddeld 42 dagen kostte om een gebruikte Volkswagen ID.3 in Duitsland te verkopen.

Februari kende een vergelijkbaar succes, waarbij gebruikte elektrische auto’s, HEV’s, benzine- en dieselvoertuigen tegen vraagprijzen werden verkocht, en niet daaronder.

Toch waren er minder kopers voor duurdere voertuigen, dus pasten de dealers hun strategieën aan door hun aanbod daarop niet te vergroten.

Dankzij een relatief stabiele maart kunnen we vooruitspoelen naar april, toen benzine- en dieselauto’s in Europa sneller verkochten dan elektrische auto’s.

In mei was er echter opnieuw sprake van een sterke stijging van de verkoop van hybride voertuigen.

Hoewel dit soort algemene feiten nuttig zijn om te bepalen wat er met de markt in het algemeen gebeurt, is het beter om uw specifieke locatie in de berekening mee te nemen, en dat is wat we u vervolgens zullen helpen doen.

Landspecifieke Q1- en Q2-marktanalyse voor gebruikte auto's

Elke regio heeft zijn eigen trends en uitdagingen die cruciaal zijn voor het nemen van weloverwogen beslissingen.

Door de landspecifieke marktgegevens voor gebruikte auto's uit het eerste en tweede kwartaal te onderzoeken, kunt u preciezere inzichten verkrijgen die relevant zijn voor de behoeften van uw dealerbedrijf. Laten we deze gedetailleerde analyses eens bekijken, zodat u beter door de markt in uw regio kunt navigeren.

Markt voor gebruikte auto's in Duitsland

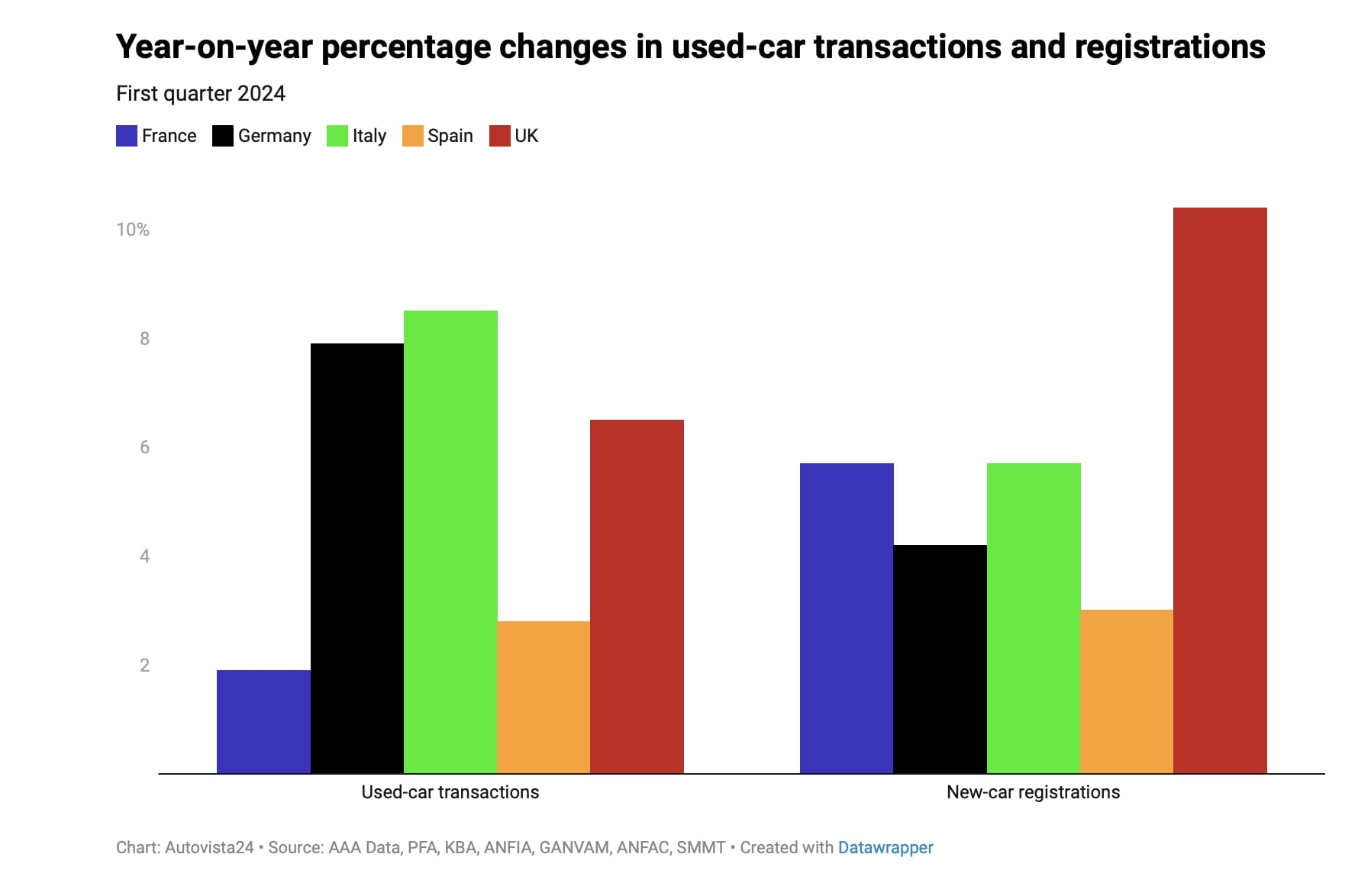

Volgens de meest recente gegevens van Autovista vertoont de markt voor gebruikte auto's in Duitsland vanaf mei 2024 tekenen van stabiliteit.

De gemiddelde inruilwaarde van personenauto's kende een kleine daling van -0,2% ten opzichte van de maand ervoor en een substantiëlere daling van -8,9% ten opzichte van een jaar geleden.

Daarentegen is de gemiddelde beurskoers licht gestegen, met 0,3% ten opzichte van de voorgaande maand en met 4,6% ten opzichte van het voorgaande jaar.

Als het gaat om het aantal verkochte auto’s is er sprake van een flinke stijging van 16% ten opzichte van 2023.

Uiteraard worden niet alle auto’s in hetzelfde tempo verkocht. De VW ID.3 was de snelste verkoper, gevolgd door Skoda KodiaQ, VW Passat en de consequent populaire Audi A3.

Snelste verkopers in Duitsland in mei 2024

Er is nog een feit waarmee u rekening moet houden wanneer u auto's aanschaft voor de inventaris van uw dealerbedrijf in Duitsland.

Hoewel de directe aankoopsubsidies voor elektrische voertuigen in 2024 zijn geëindigd, zijn er nog steeds aanzienlijke belastingvoordelen voor het bezitten en gebruiken van elektrische en hybride voertuigen. BEV's die tot 31 december 2025 zijn geregistreerd, genieten bijvoorbeeld een tienjarige vrijstelling van eigendomsbelasting, verlengd tot 31 december 2030.

Het is dus niet nodig dat autodealers stoppen met investeren in hybrides en elektrische voertuigen.

Maar hoewel elektrische en hybride voertuigen steeds populairder worden, kunnen alle soorten auto's op brandstof nog steeds winstgevend zijn. Kijk maar eens naar de lijst met snelste verkopers!

Markt voor gebruikte auto's in Frankrijk

Een blik op de gegevens van Autovista voor mei 2024 laat zien dat, hoewel er geen drastische veranderingen zijn in de autoprijzen, de markt voor gebruikte auto's in Frankrijk een lichte daling in de inruilwaarde kende (-0,2%).

Bovendien is het aantal verkochte auto’s met -4,4% gedaald ten opzichte van april 2024.

Ondanks deze dalingen zijn er twee positieve veranderingen in de markt.

De gemiddelde tijd om een gebruikte auto te verkopen verbeterde en daalde met 2,2 dagen ten opzichte van de voorgaande maand, wat wijst op een snellere verkoop.

Bovendien steeg de actieve marktvolume-index met 3,2%, wat mogelijk wijst op meer kopersactiviteit.

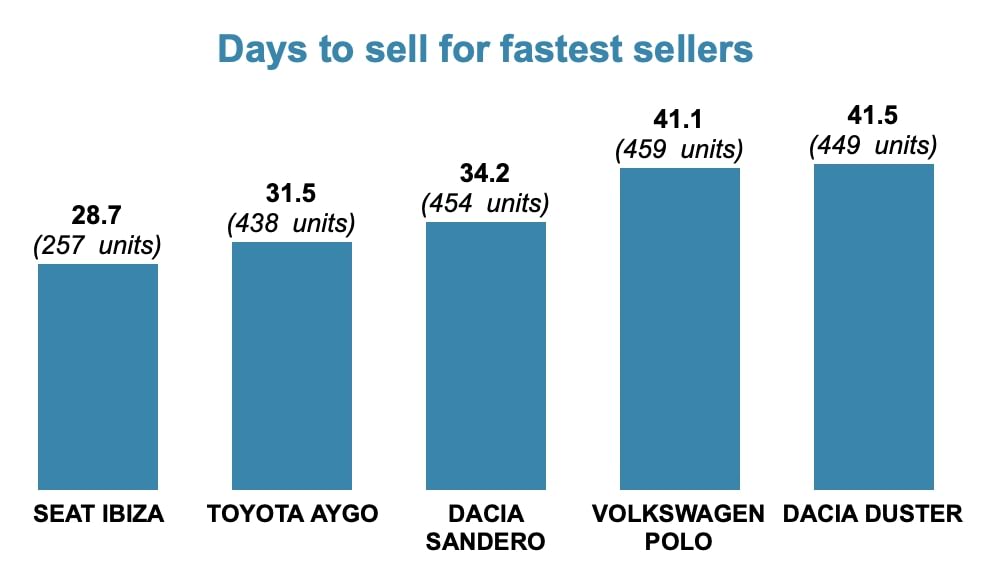

Klanten lijken vooral geïnteresseerd te zijn in kleine en zuinige auto's, aangezien de snelste verkopers in Frankrijk Seat Ibiza, Toyota Aygo en Dacia Sandero zijn.

Snelste verkopers in Frankrijk

Alles bij elkaar genomen hebben het eerste en tweede kwartaal in Frankrijk enkele tegenstrijdige trends laten zien.

Tegenstrijdige cijfers suggereren zowel een vertraging van het verkoopvolume als een toegenomen marktactiviteit. Voor autodealers betekent dit dat, hoewel de totale verkoopcijfers zijn gedaald, de auto's die op de markt zijn sneller verkopen.

Deze concurrerende marktomstandigheden maken het van cruciaal belang om de juiste voorraad op voorraad te hebben. Gelukkig kan Autovista's lijst met populaire auto's u helpen te zien naar wat voor soort personenauto's klanten op zoek zijn.

Als u specifiek op zoek bent naar top-EV’s in Frankrijk vanaf mei 2024, kunt u ook deze lijst bekijken die is opgesteld door de Europese Commissie.

Markt voor gebruikte auto's in Italië

Vergeleken met andere landen ervaart de Italiaanse markt voor gebruikte auto's een enigszins unieke situatie.

Gegevens van Autovista suggereren namelijk dat er sprake is van een daling in het verkoopvolume, terwijl voertuigen tegen hogere prijzen worden verkocht. Wilt u meer details weten?

De daling is behoorlijk aanzienlijk: het aantal verkochte auto's is met -42,5% gedaald ten opzichte van de voorgaande maand en met -38,4% ten opzichte van het voorgaande jaar.

Aan de andere kant brengen de auto's die wel verkocht worden hogere prijzen op. De gemiddelde beurskoers steeg met 2,2% ten opzichte van de voorgaande maand en met een indrukwekkende 11,3% vergeleken met het voorgaande jaar.

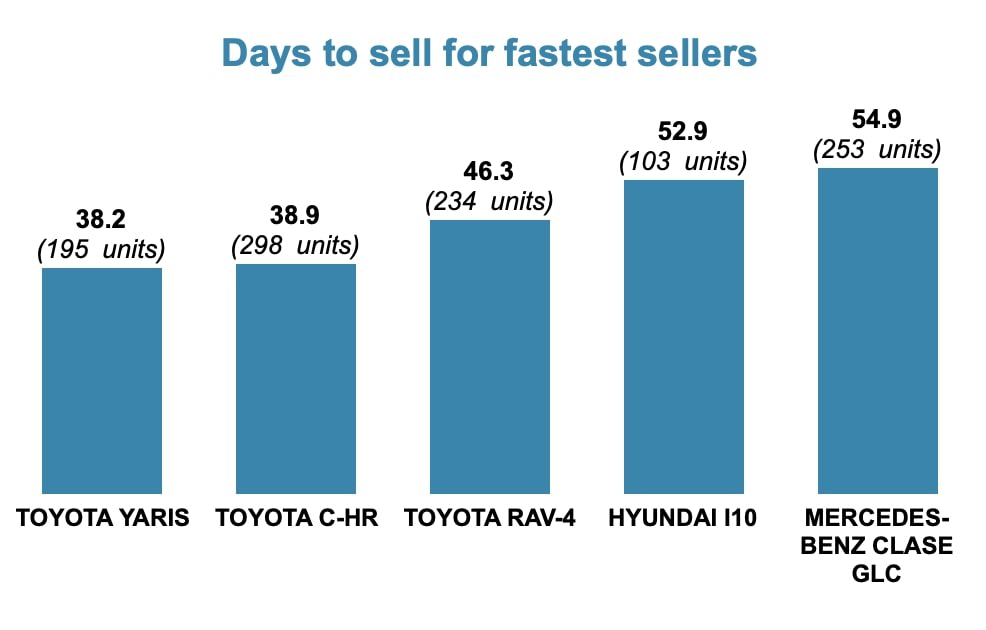

Deze trends komen ook tot uiting in de lijst van snelst verkopende auto’s in Italië. Kijk hier eens:

In eerste instantie lijkt het erop dat de markt het goed doet, omdat de twee snelste verkopers (Volvo XC60 en BMW X1 ) gemiddeld slechts 28,2 en 33 dagen nodig hebben om te verkopen – dat is vergelijkbaar met de Franse trends.

Als u echter kijkt naar het aantal snelste verkopers dat in heel Europa wordt verkocht, zult u merken dat Italië een aanzienlijk lager volume heeft, wat wijst op een tragere algemene markt, ondanks de snelle verkoop van specifieke modellen.

In wezen is het hebben van een ruime keuze aan wisselvallige modellen op dit moment misschien niet de beste strategie voor dealers in Italië. In plaats daarvan zou het beter zijn om zich te concentreren op voertuigen waar veel vraag naar is, zodat dealers de algehele daling van het verkoopvolume kunnen compenseren met minder, maar duurdere verkopen.

Markt voor gebruikte auto's in Spanje

De eerste twee kwartalen van 2024 waren veelbewogen op de Spaanse markt voor gebruikte auto’s. Gekenmerkt door een aanzienlijke stijging van het verkoopvolume, laten ze zien dat er vraag is naar gebruikte voertuigen, ondanks de langere gemiddelde verkooptijden.

In termen van totale restwaarden was er in het eerste en tweede kwartaal van 2024 sprake van een lichte daling van -5,7% ten opzichte van 2023. Toch wijst de vergelijking tussen april en mei 2024 erop dat er positieve signalen zijn voor de markt, waarbij de handelsrestwaarde met 0,5% stijgt tussen deze twee maanden.

Uit gegevens van Autovista blijkt ook dat de verkoopvolume-index voor mei 2024 aanzienlijk is gestegen, met 79,2% vergeleken met de voorgaande maand en met 51,2% vergeleken met het voorgaande jaar. Dat is een substantiële stijging!

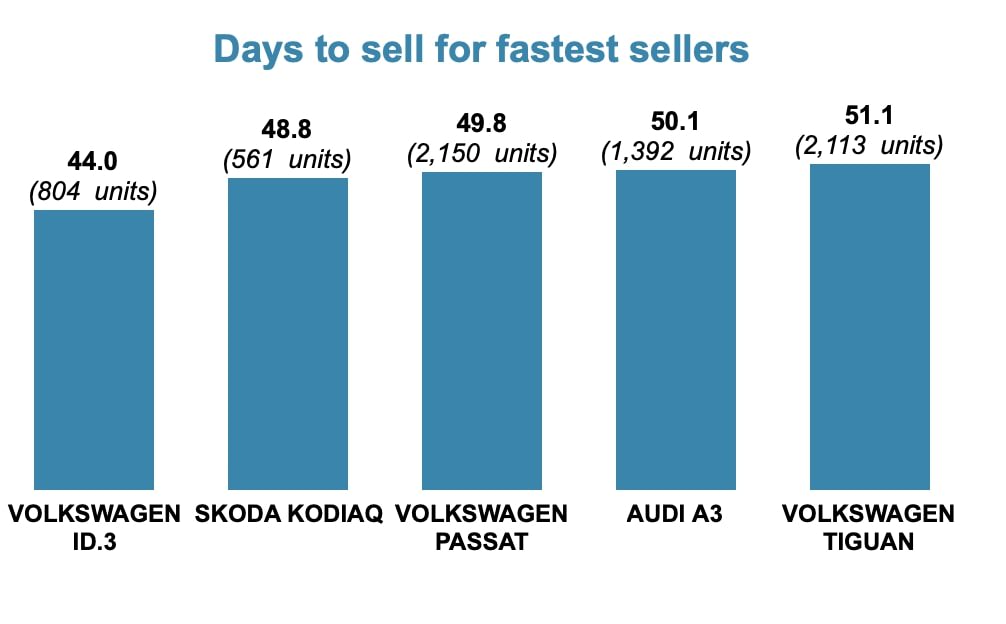

Toch vliegen gebruikte auto's nog niet helemaal van de kavels.

Zelfs de snelst verkopende auto, Toyota Yaris, heeft 38 dagen nodig om te verkopen.

Het model wordt gevolgd door Toyota C-HR en Toyota RAV4, die respectievelijk 38,9 en 46,3 dagen nodig hebben om te verkopen.

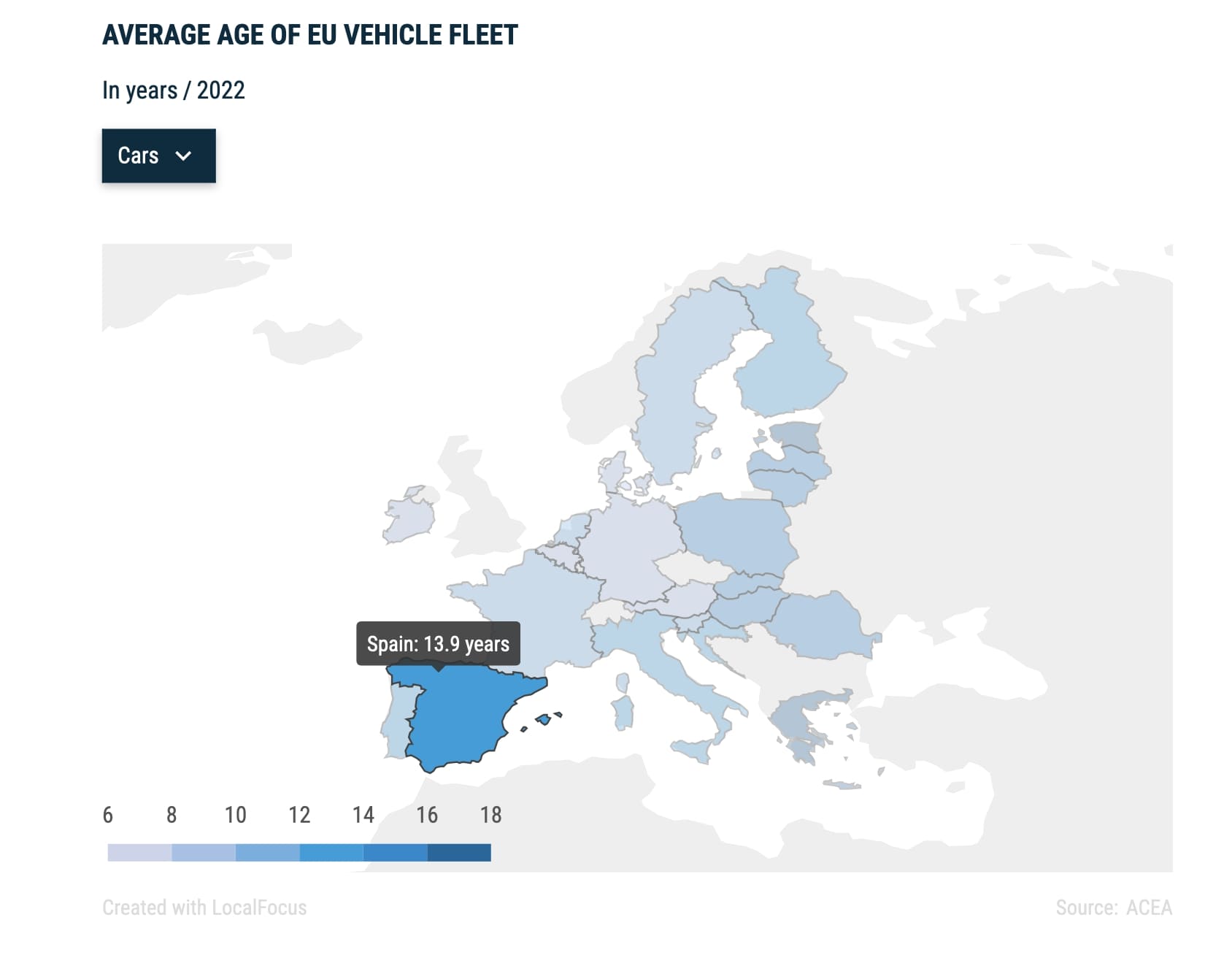

Langere verkooptijden zijn ook in lijn met het feit dat Spanje een van de oudste wagenparken in de EU heeft, met een gemiddelde leeftijd van 13,9 jaar.

Bron: ACEA

Bron: ACEA

Oudere wagenparken kunnen bijdragen aan de lagere omloopsnelheid, omdat kopers mogelijk voorzichtiger en selectiever zijn bij de aankoop van gebruikte voertuigen.

Deze trends weerspiegelen de complexe dynamiek van de Spaanse markt voor gebruikte auto's, waar de vraag sterk blijft, maar dealers zich mogelijk moeten aanpassen aan langere verkoopperioden.

Markt voor elektrische en hybride gebruikte auto's in Europa

Als u de topverkopers in de grote Europese regio’s scant die we hierboven hebben besproken, ziet u een behoorlijk aantal elektrische voertuigen op de lijsten.

De EV-boom lijkt echter tot rust te zijn gekomen vergeleken met de voorgaande jaren. De trend is ook duidelijk zichtbaar bij nieuwe auto’s: batterij-elektrische voertuigen vertegenwoordigen in mei 2024 12,5% van de EU-automarkt, tegen 13,8% een jaar geleden.

Een mogelijke reden voor het verminderde enthousiasme kan in verschillende factoren liggen:

- Hoge prijzen voor nieuwe BEV's

- Gebrek aan beschikbaarheid van opladen voor particulieren

- Te weinig openbare oplaadpunten

Dit betekent niet dat milieubewuste kopers hun interesse in milieuvriendelijke voertuigen hebben verloren. In plaats daarvan wenden ze zich tot hybriden.

Volgens ACEA was hybride-elektriciteit, ondanks de algemene marktdaling, het enige segment dat groei kende. Deze nieuwe autogegevens vertalen zich ook naar de markt voor gebruikte auto's, waar de toenemende populariteit van hybride voertuigen wordt weerspiegeld in een grotere vraag en snellere verkopen.

Nu er meer hybride modellen beschikbaar komen en de markt voor gebruikte auto's betreden, zullen consumenten die op zoek zijn naar milieuvriendelijke opties eerder voor hybrides kiezen omdat deze praktisch zijn en profiteren van betere infrastructuurondersteuning in vergelijking met BEV's.

eCarsTrade als een manier voor dealers om gemakkelijk Europese auto's te kopen

Nadat u het overzicht van de markt in uw regio heeft gezien, heeft u wellicht een aantal goede ideeën gekregen over welke auto's u in uw dealerbedrijf op voorraad wilt hebben.

Wij zijn er om u te helpen: ons platform eCarsTrade maakt het kopen van deze voertuigen eenvoudiger dan ooit.

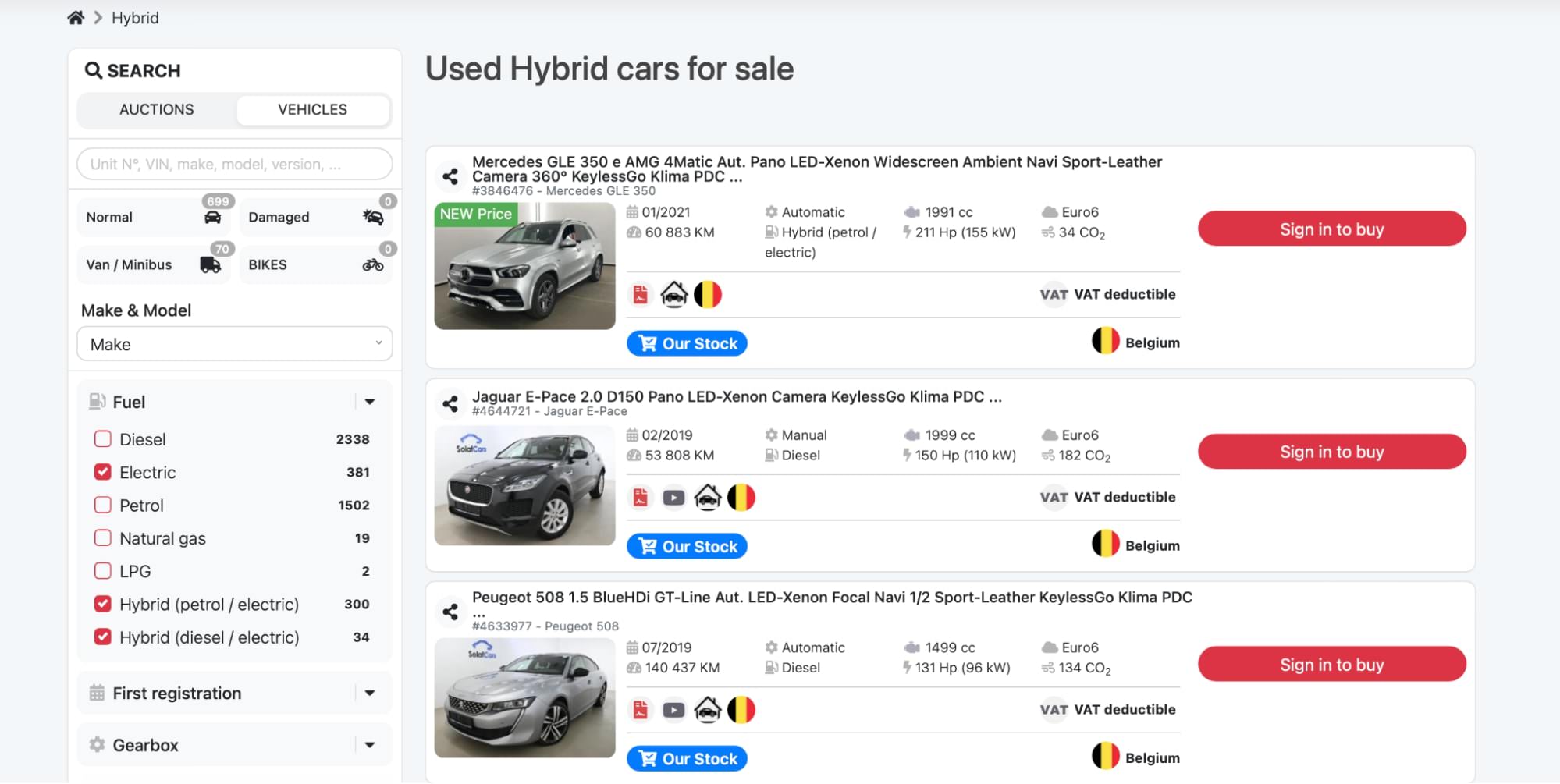

Voortdurend bijgewerkte hybride vermeldingen

Voortdurend bijgewerkte hybride vermeldingen

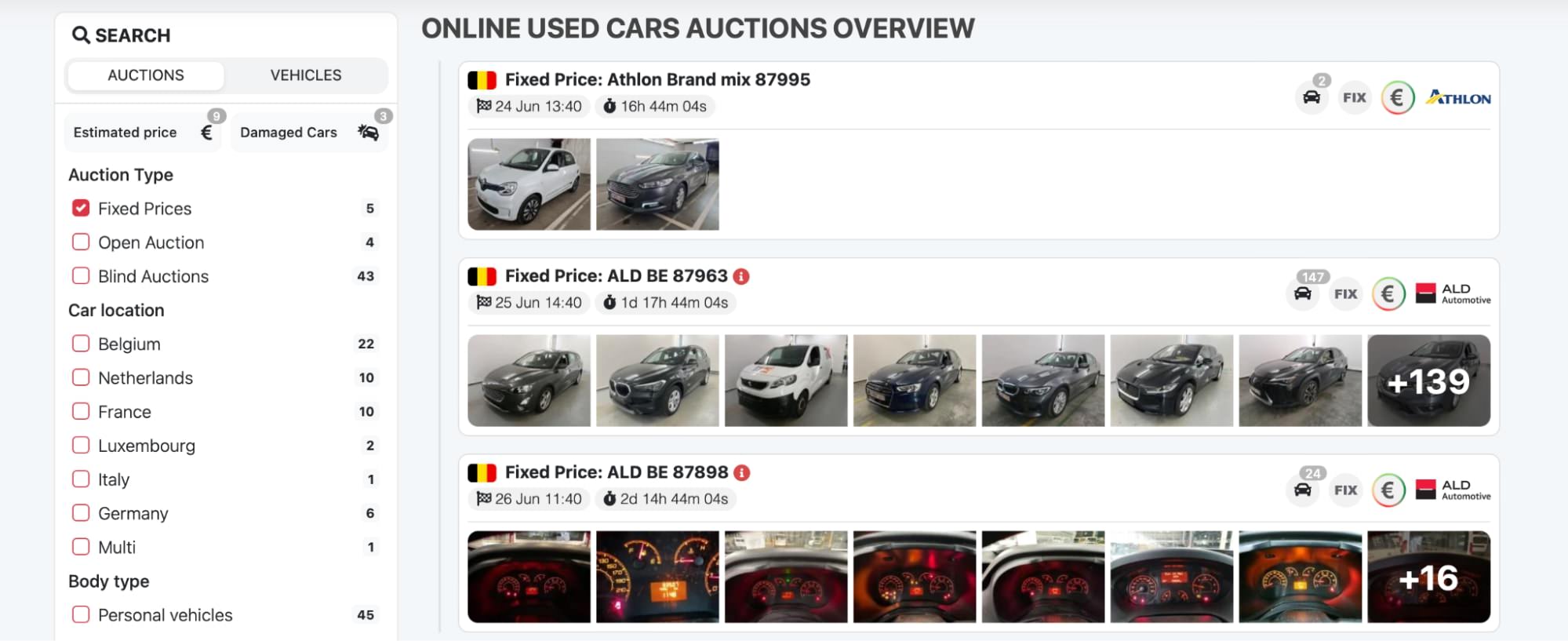

Het platform bevat honderden voertuigen van verschillende actieve EU-veilingen, wat betekent dat dealers van gebruikte auto's op één plek toegang hebben tot een breed scala aan ex-leaseauto's die te koop zijn.

Wij bieden twee soorten veilingen aan: blind en open. Bij blinde veilingen dient u uw bod in zonder dat u de biedingen van anderen kent, terwijl u bij open veilingen concurrerende biedingen in realtime kunt zien en erop kunt reageren.

Niet geïnteresseerd in bieden? Geen probleem! U kunt ook voertuigen vinden die beschikbaar zijn tegen vaste prijzen, wat een eenvoudige aankoopoptie biedt.

Welke optie u ook kiest, onze medewerkers staan klaar om u te helpen op welke manier dan ook, of het nu gaat om het regelen van doorvoerkentekens, het voorbereiden van douaneaangiften of iets anders dat u nodig heeft om uw inventaris uit te breiden.

Sla op tijd een voorraad in, zodat u klaar bent voor alles wat het derde en vierde kwartaal met zich meebrengt.

Factoren die de trends op de markt voor gebruikte auto's in het eerste en tweede kwartaal van 2024 bepaalden

Veranderingen in de markt komen zelden willekeurig voor; er zijn meestal redenen achter het gedrag van klanten.

Als u meer te weten komt over de factoren die deze trends beïnvloeden, kunt u zowel de marktdynamiek als de klantvoorkeuren echt begrijpen.

Hier is dus een overzicht van de belangrijkste factoren die 2024 tot nu toe hebben gevormd:

Overheidsbeleid en stimuleringsmaatregelen

Verschillende Europese landen bieden belastingvoordelen, subsidies en stimulansen voor de aanschaf van milieuvriendelijke voertuigen, waardoor de vraag naar elektrische en hybride auto’s op de markt voor gebruikte auto’s wordt gestimuleerd. Bijvoorbeeld:

- Duitsland biedt tienjarige belastingvrijstellingen voor BEV's en FCEV's die tot 31 december 2025 zijn geregistreerd. Hoewel de vrijstelling niet van toepassing is op gebruikte auto's, stimuleert deze de markt voor gebruikte auto's door het aanbod van betaalbare EV's te vergroten.

- Frankrijk steunt burgers met de ecologische bonus en biedt financiële steun voor de aankoop of lease van voertuigen met een lage uitstoot, inclusief gebruikte auto's.

- Italië biedt verschillende stimulansen om de aanschaf van voertuigen met een lage uitstoot te bevorderen, zoals de Nationale Aankoopsubsidie voor Particulieren. In totaal heeft Italië 250 miljoen euro toegewezen voor BEV’s voor de jaren 2022, 2023 en 2024.

Dergelijke prikkels stimuleren de opname van elektrische en hybride voertuigen, wat ook betekent dat ze beschikbaar zijn als gebruikte auto.

Economische omstandigheden

De dalende inflatie, gekoppeld aan de gematigde economische groei, heeft de gestage vraag naar gebruikte auto's ondersteund.

Een verschuiving in de voorkeuren van de consument

Er heeft een merkbare verschuiving plaatsgevonden naar zuinigere en milieuvriendelijkere voertuigen. Stijgende brandstofprijzen hebben, naast het milieubewustzijn, er ook toe geleid dat meer consumenten voor hybrides en elektrische voertuigen hebben gekozen.

Bied mee op tweedehands EV’s uit Europa!

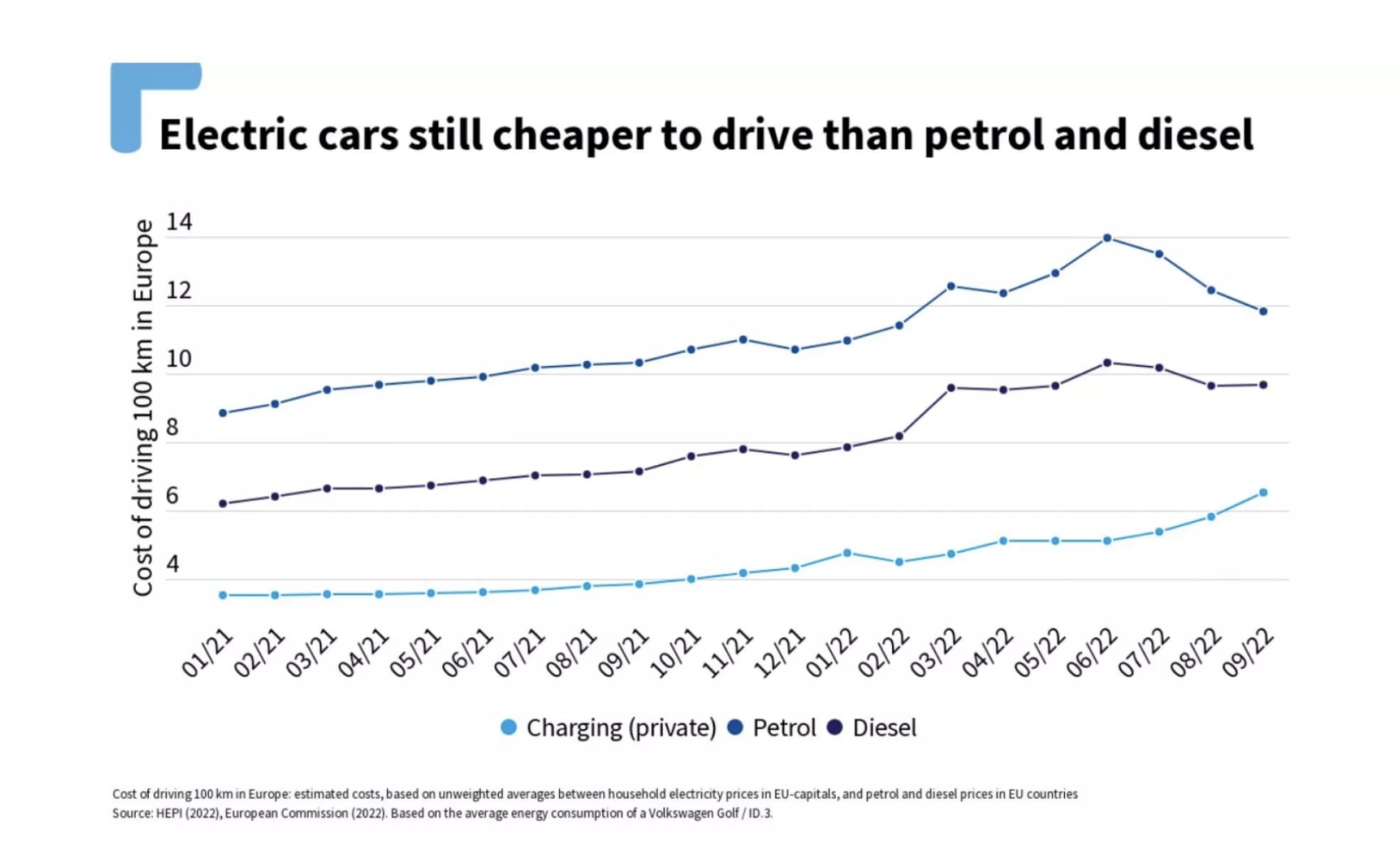

Kijk naar de kosten van het rijden van 100 km in Europa, en u begrijpt de aantrekkingskracht die klanten ervaren als ze een auto kiezen om te kopen.

De kosten voor het rijden van 100 km in Europa

De kosten voor het rijden van 100 km in Europa

Of klanten nu op zoek zijn naar milieuvriendelijke voertuigen of op de lange termijn minder geld willen uitgeven, elektrische voertuigen en hybrides zijn in wezen aantrekkelijke opties.

Technologische vooruitgang

Innovaties op het gebied van voertuigtechnologie, zoals een verbeterde levensduur van de batterij voor elektrische voertuigen en een verbeterde brandstofefficiëntie voor hybrides, hebben deze auto’s aantrekkelijker gemaakt voor consumenten.

Vergeet ook de technologische ontwikkelingen in de markt zelf niet, zoals online marktplaatsen. Deze hebben ook de manier bepaald waarop klanten gebruikte auto's kopen.

U moet er natuurlijk ook rekening mee houden dat klanten niet helemaal tevreden zijn met het bestaande aantal laadpunten in heel Europa. Daarom verwachten we dat traditioneel aangedreven auto's, ondanks alle verbeteringen, hun aanwezigheid op de markt zullen behouden.

Verouderende wagenparken

De gemiddelde Europese leeftijd van lichte bedrijfsvoertuigen is 12 jaar. Naarmate deze voertuigen ouder worden en minder betrouwbaar worden, zullen particuliere en zakelijke consumenten eerder op zoek gaan naar nieuwere modellen die betere prestaties, veiligheid en brandstofefficiëntie bieden, zelfs als ze worden gebruikt.

Het is dus niet slechts één factor; het is de combinatie van economische, politieke en technologische belangrijke ontwikkelingen die de markt voor gebruikte auto's vormgeven.

Zijn de prijzen van gebruikte auto’s in 2024 lager geworden?

Als u onze voorspellingen over de autoprijzen in 2024 hebt gelezen, herinner u zich misschien dat we drie mogelijke scenario’s hebben voorgesteld. Eén daarvan bleek juist te zijn – en dat was ons basisscenario.

In de buurt van wat werd verwacht, zijn de prijzen van gebruikte auto's inderdaad licht gedaald. Deze subtiele daling maakt gebruikte auto's beter beschikbaar voor klanten en biedt dealers mogelijkheden om hun voorraad efficiënt te rouleren.

Met andere woorden: 2024 is een goed jaar voor de tweedehandsautobranche, omdat zowel vraag als aanbod aanwezig zijn.

Conclusie

Als uw bedrijf de post-pandemische inflatie heeft overleefd, kan het alles overleven.

Gelukkig lijken er in de tweede helft van 2024 geen grote calamiteiten te zijn waar we ons zorgen over hoeven te maken. De markt vertoont tekenen van stabiliteit en een bescheiden herstel.

Optimistische trends in het aantal verkochte auto's en licht gedaalde prijzen voor gebruikte auto's duiden op een veerkrachtige markt. De economische omstandigheden en de veranderende voorkeuren van consumenten ten aanzien van hybrides en elektrische voertuigen dragen allemaal zeker bij aan positieve vooruitzichten.

Dus omarm deze veranderingen, houd de beste mogelijkheden voor ex-leaseauto’s in de gaten, en uw dealerbedrijf zal kunnen floreren.